Introduction:

Stochastic Process was invented by Dr. George C. Lane many years ago under this basic premise: During periods of decrease daily closes tend to accumulate near the extreme low of the day and conversely during periods of increase daily closes tend to accumulate near the extreme highs of the day.

This indicator is designed to show conditions of overbought and oversold markets. Stochastics are divided into two types regular Stochastics, often referred to as Fast Stochastics, and Slow Stochastics. Fast Stochastics are said to be more sensitive to price changes and can give very greatly in the short-term, hence the need for Slow Stochastics.

Interpretation:

Stochastics display two lines that move in a vertical scale between 0 and 100 - representing percentiles from 0% to 100%. Think of the level of Stochastics as where the most current close is within a specific range. For example, if Stochastics are reading 50%, the current close is in the middle of the price range for specified period of time. If Stochastics are reading 100%, the close is at the high of the range, and 0% represents current close price being at the low of the range. Of course, because Stochastics are smoothed this is not exactly true, but should help you visualize the information being shown. This will also help you to understand why Stochastics are a counter trend indicator, in that the underlying principle behind Stochastics is that prices will move back to the center of the trading range, or the opposite extreme.

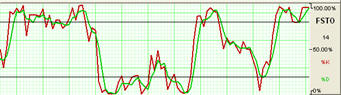

When both lines move to an area below 20 on this scale they are said to be in an oversold zone. Conversely, when both %K and %D move to above 80 on this same scale they are indicating overbought. It is this indication of market sentiment that makes this counter trend indicator useful.

George Lane emphasized that the most important signal generated by this method was the difference or divergence between %D and the underlying market price. He said that the divergence is where %D line makes a group of lower highs while the market makes a series of higher highs. This would indicate an overbought condition. The reverse would be true of an oversold market, with %D making higher lows and prices making lower lows.

Trade triggers to buy are created when, during an oversold condition (Stochastics below 20) the slow line, %D is crossed by the faster moving line, %K.

The opposite would occur with a sell signal. The faster %K line crosses above the slower %D line, when both are at a reading above 80.

As with a dual moving average system when the faster reacting indicator crosses the slower moving indicator a buy or sell is signaled. Because Stochastics give an indication of either overbought or oversold you would first want to see both lines in that above 80 or below 20 range and sloping out of that range back to the middle before looking for these trade triggers.

Example of FSTO in the Indicator Window:

Calculation:

Parameters:

Overall Period (3) - the number of periods used to determine the highest high and lowest low.

%D MA Period (14) - the number of periods used to determine the moving average for the %D value.

Formula:

The first step in computing the stochastic indicator is to determine the n period high and low. For example, suppose you specified twenty periods for the stochastic. Determine the highest high and lowest low during the last twenty trading intervals. It determines the trading range for that time period. The trading range changes on a continuous basis.

The calculations for the %K are as follows:

%Kt = ( (Closet - Lown) / (Highn - Lown) ) * 100

%Kt - The value for the first %K for the current time period.

Closet - The closing price for the current period.

Lown - The lowest low during the n periods.

Highn - The highest high during the n time periods.

n - The value you specify.

Once you obtain the %K value, you start computing the %D value which is an accumulative moving average. Since the %D is a moving average of a moving average, it requires several trading intervals before the values are calculated properly. For example, if you specify a 20 period stochastic, the software system requires 26 trading intervals before it can calculate valid %K and %D values. The formula for the %D is:

%DT = ( (%DT-1 * 2) + %Kt) / 3

%DT - The value for %D in the current period.

%DT-1 - The value for %D in the previous period.

%Kt - The value for %K in the current period.

The values 2 and 3 are constants. You specify the constants and the length of the time period to examine for the trading range.

Customizing:

To change the settings of this indicator, open the Program Options screen by clicking the Program Options button located on the main Toolbar. See the Program Options section for more details on changing the settings.